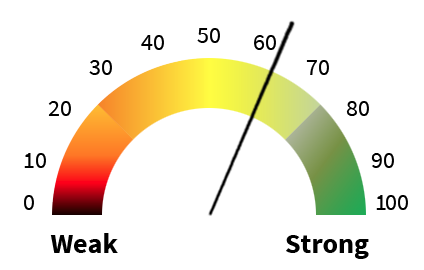

Economy

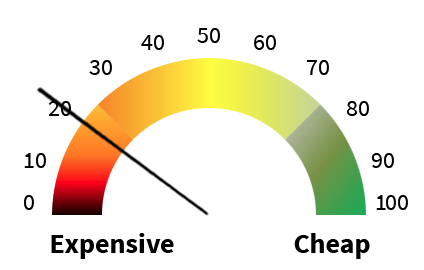

Valuation

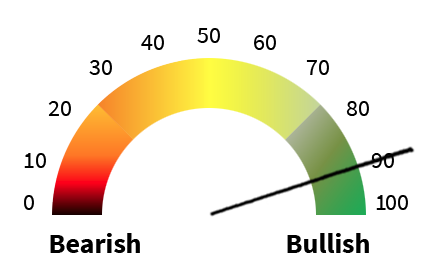

Sentiment

U.S. Economy—Mixed positive and negative news. Economy appears to be growing slowly.

-

Our forecast for next year has changed from an economic soft landing to a recession starting in early 2023. This recession is expected to be mild and last three quarters because of still solid underlying fundamentals (e.g., labor market, etc.).

- Based on the Federal Reserve Bank of Philadelphia’s U.S. Coincident Index, our gauge of U.S. economic activity (above left) registers a July 2022 reading at the 63rd percentile (weakening from 87th last month).

-

Recent developments:

-

The Federal Reserve approved its third consecutive interest-rate increase of 75 bps and signaled additional large increases were likely at coming meetings as it combats inflation. They also initiated a program to begin withdrawing stimulus.

Capital Markets—The S&P 500 declined sharply in recent weeks and was down 22.4% YTD as of 9/26/22.

-

Valuation:

-

Based on the S&P 500 trailing 12-month price-to-earnings ratio, our gauge of U.S. equity valuation (above center) registers a current reading in the 21st percentile. Stock valuations are lower than a year ago at similar earnings levels.

-

Sentiment:

- Based on the National Association of Active Investment Manager’s Exposure Index, a contrarian indicator, our gauge of U.S. stock market sentiment (above right) registers a 9/21/22 reading in the 90th percentile (bullish).

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. Reliance upon information in this material is at the sole discretion of the reader.