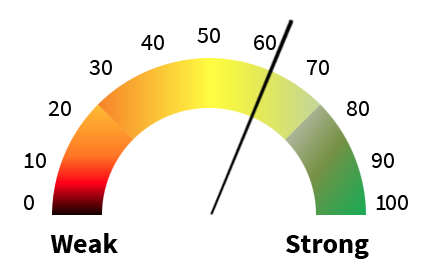

Economy

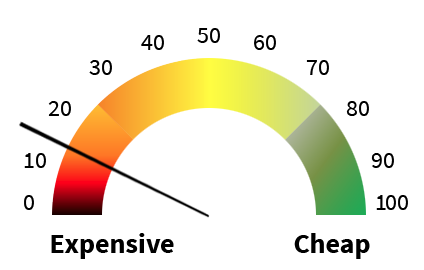

Valuation

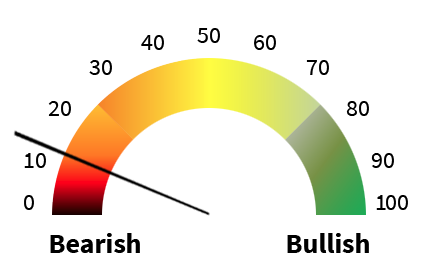

Sentiment

U.S. Economy—Remember synchronized growth? The U.S. economy accelerates while

the rest of the world falters.

- We expect 2018 real U.S. GDP to grow at about a 2.5%-3.0% rate. In our opinion, the probability of a U.S. recession is low.

- Based on the Federal Reserve Bank of Philadelphia’s U.S. Coincident Index, our gauge of U.S. economic activity (above left) registers a February 2018 reading in the 62rd percentile.

- Recent developments:

- In a move that

was widely expected, the Federal Reserve raised interest rates 25 bps following its June FOMC meeting. Policymakers’ projections indicate two additional hikes by the end of the year. Previously, one additional hike was expected.

Capital Markets—After returning more than 37% in 2017, emerging markets struggle

while facing a rising dollar.

- Valuation:

- Based on the S&P 500 trailing 12-month price-to-earnings ratio, our gauge of U.S. equity valuation (above center) registers a current reading in the 15th percentile.

- Sentiment:

- Based on the National Association of Active Investment Manager’s Exposure Index, a contrarian indicator, our gauge of U.S. stock market sentiment (above right) registers a June

20, 2018 reading in the 13th percentile.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. Reliance upon information in this material is at the sole discretion of the reader.